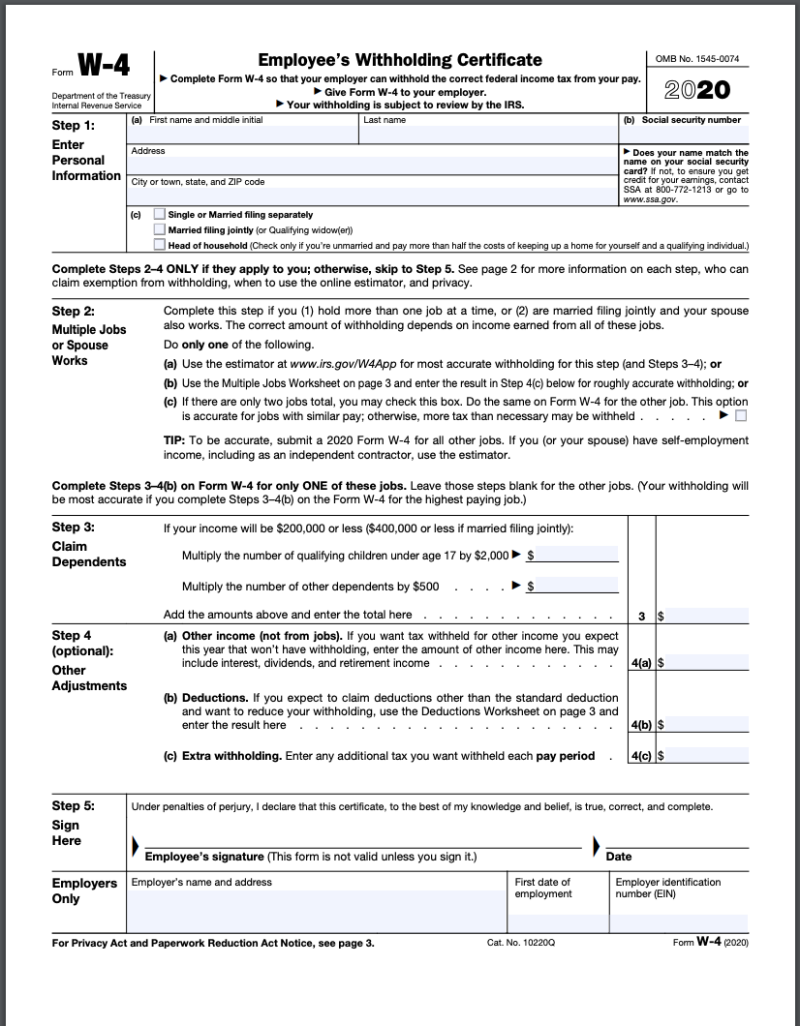

2020 brings a change to the form used by employers to withhold your Federal taxes, form W-4. With the tax law changes of 2018, many found they were not withholding enough tax. This redesign should help with making sure you are having enough tax taken from your paycheck.

2020 brings a change to the form used by employers to withhold your Federal taxes, form W-4. With the tax law changes of 2018, many found they were not withholding enough tax. This redesign should help with making sure you are having enough tax taken from your paycheck.

Who should be concerned? For the most part, if a worker’s tax status hasn’t changed from last year, they don’t need to fill out a new W-4. New employees and those who experienced a major life event like getting married or having a child need to submit a new one. Also, if you’re unhappy with your 2019 tax outcome – say, you get a smaller refund or owe money to Uncle Sam – you should also complete a new W-4.

Yahoo posted an article explaining the changes and possible benefits it brings. Read full article HERE.

You can also get your questions answered at the IRS website FAQ’s

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Carla J. Merlak are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.